Bonded Factory

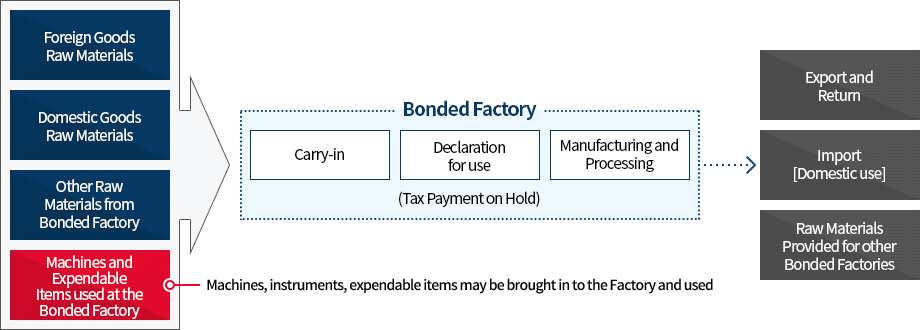

What is a Bonded Factory?

- A bonded factory is a licensed bonded area where manufacturing, processing and other similar jobs are done using foreign and domestic goods as raw materials

- At Bonded factories, it is possible to use foreign raw materials with reservation of tax, which helps to ease the financial burden and boost processing trade.

Customs Procedures in the Bonded factory.

Overview

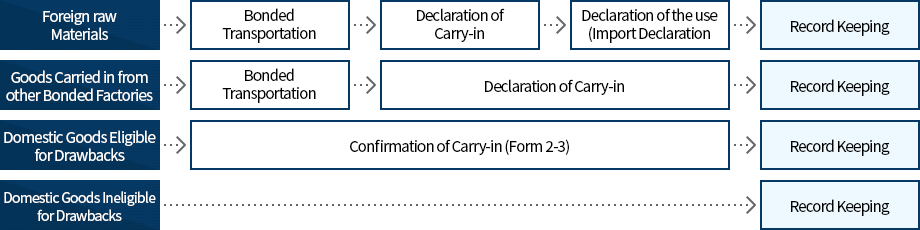

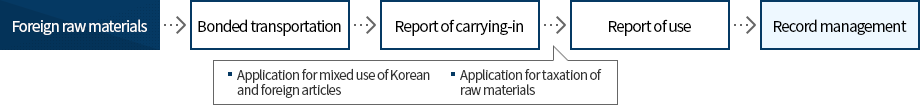

Goods control processes by the type of raw materials:

Release procedures from the bonded factory:

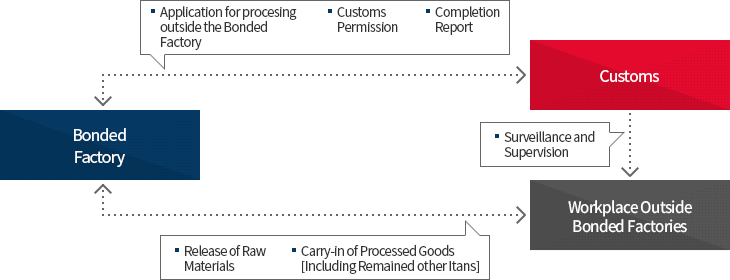

Operations outside bonded factory

Certain parts of bonded processing may be conducted outside of the bonded factory if it is necessary to promote the processing industry or domestic market

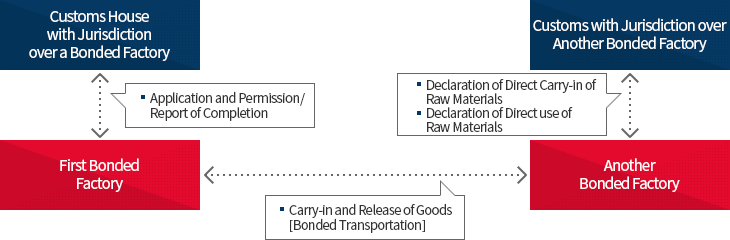

Temporary bonded processing at other bonded factories:

It is possible to carry out a part of bonded processing at another bonded factory

- 원 보세공장관할세관과 원 보세공장(Bonded Area)이 신청, 허가/완료보고

- 타 보세공장관할세관과 타 보세공장(Bonded Area)이 원료 직접 반입신고 / 원료 직접 사용신고

- 원 보세공장(Bonded Area)과 타 보세공장(Bonded Area)이 물품반출입(보세운송 절차)

Time point of taxation

Application for the mixed-use of domestic and foreign goods or taxation on raw materials shall be made before the “report of use” of raw materials.

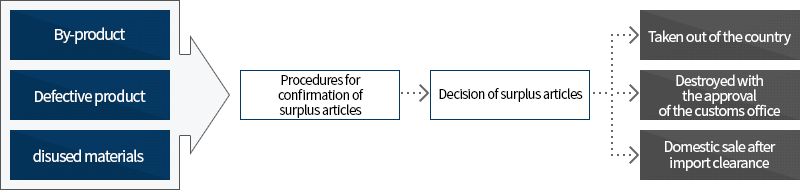

Procedures for handling surplus goods

The surplus goods left in the bonded area after working shall be recorded in the “Surplus Goods Management Register” for management purposes. They can be disposed of after obtaining approval of the head of a customs office. If the remainder after the disposal has a real value, customs duty and other applicable taxes will be imposed based on the property and quantity of the goods.

Requirement amount and inventory management

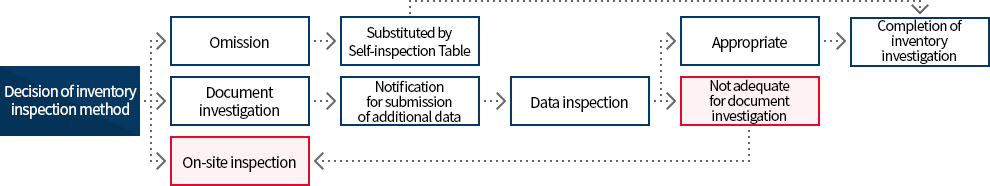

- The operator shall prepare and keep the ‘Actual Requirement Calculation Sheet of Raw Materials’ for the produced products, conduct self-inspection of the status of inventory management within 15 days from 3 months after the end of the fiscal year and submit the ‘Self-inspection Table’ to the head of the customs office.

- The head of the customs office shall decide the omission of inventory inspection, document investigation, or on-site investigation after reviewing the submitted Self-inspection Table

For more information

Export and Import Cargo Division of Korea Customs Office 042-481-7823

Relevant regulations

- Article 185 of the Customs Act (Bonded factory)

- Article 188 of the Customs Act (Taxation on products) and Article 204 of its Enforcement Decree (Approval of mixed use of foreign goods and Korean goods)

- Article 189 of the Customs Act (Taxation on raw materials) and Article 205 of its Enforcement Decree (how to apply for the application of taxation of raw materials, etc.)

- Article 206 of the Customs Act (Bookkeeping duty of the operator of bonded factory)

- Article 207 of the Enforcement Decree of the Customs Act (inventory)

- Announcement on the operation of bonded factory