Import Declaration Guideline

Overview

Import Clearance

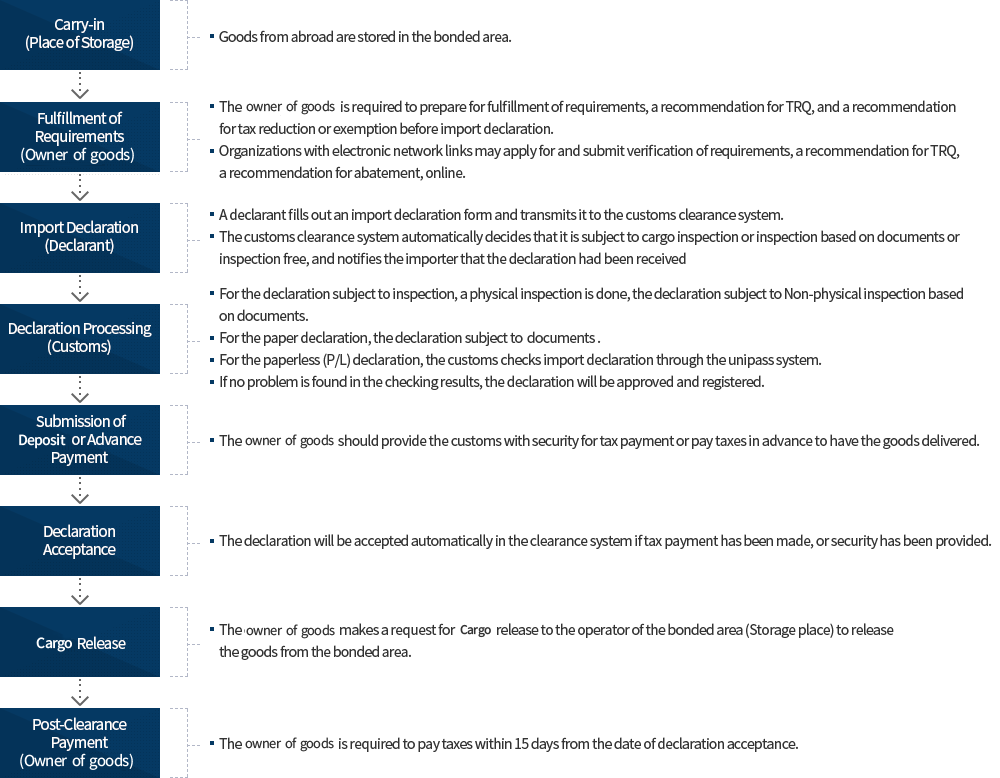

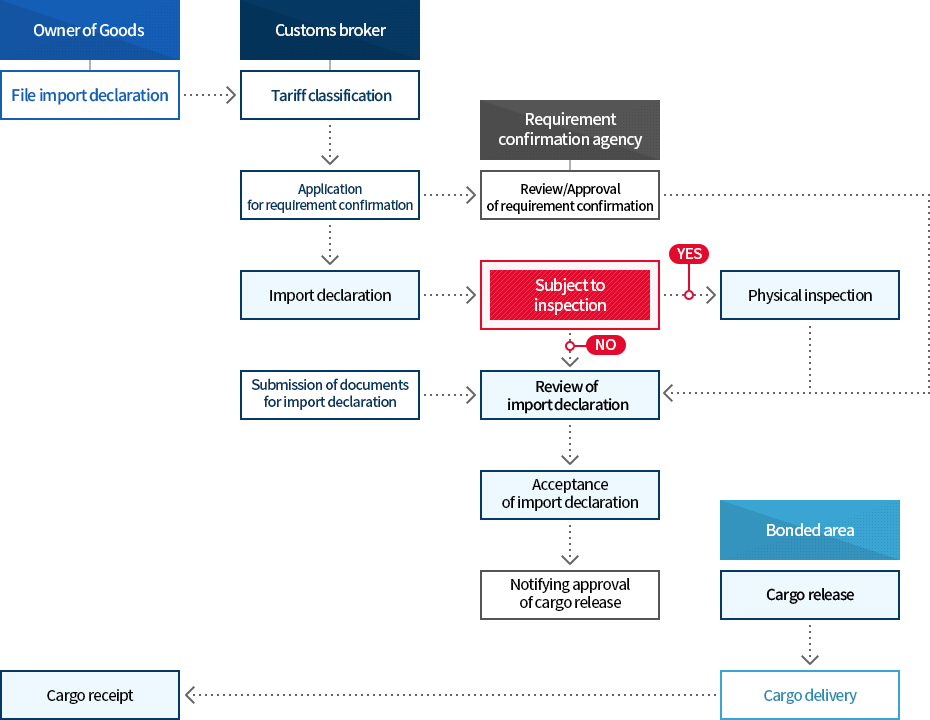

Import clearance refers to a series of procedures for the release of imported goods. The importer declares goods to be imported to the Head of a customs, who would accept the declaration if it is legitimate according to the Customs Act and other regulations. Customs then issue the certificate of import declaration to the declarant to ensure that the imported goods are legitimately declared. All these procedures are dealt with in the KCS online-based electronic clearance system, UNIPASS.

Declaration details and timeline

- Method : Upload the information on the UNIPASS of KCS

Use the Korea Customs Service's UNI-PASS (http://unipass.customs.go.kr) to submit online applications and declarations, as well as import declarations. Contact the UNI-PASS technical support center (☎1544-1285) for more information on using the system.

- Declarant : a customs broker or owner of goods

- Timepoint : In principle, importers are required to declare import after the goods arrive at the port. However, to expedite the process, importers may file the declaration before the arrival of goods.

Required Documents

- 1 Basic document : an import declaration form (through the EDI, or Internet)

- 2 Additional documents : an invoice, a packing list, a B/L, a C/O, a certificate of inspection (Quarantine), etc.

Inspection and processing of imports

- Screening goods for Inspection : Based on risk management technique and cargo data analysis, goods to be inspected are selected

- Purpose of Inspection: To ensure the accuracy of the import declaration, such as the item description, quantity, country of origin, and trademark, etc

- Inspection costs : Borne by the owner of goods

- Inspection methods : 100% cargo inspection or partial inspection, or component analysis by customs laboratory, Inspection using technical equipment

- Disciplinary measures against illicit imports detected: Correction of declaration errors, subject to a fine or criminal charge

Acceptance of Declaration

- The Head of a customs accepts an import declaration if it is found to have no errors upon the import inspection and documentary check.

- However, a correction may be requested, or the customs clearance may be suspended in the following cases

Correction Requests

- 1 The requested information is missing in the declaration

- 2 The review of the declaration form finds that the document to be attached is missing, or evidentiary documents should be supplemented.

- 3 If P/L (simplified) declaration is required to be changed into a general declaration by documents

Withholding of Customs Clearance

- 1 IIf it is required to complement the matters stated in the declaration on import, export, or return according to Article 241 or 244 of the Customs Act

- 2 If it is necessary to submit the additional required documents according to Article 245 of the Customs Act

- 3 If the obligations in the Customs Act are violated, or there are concerns of public health threats

- 4 If it is necessary to conduct safety inspection according to Paragraph 1, Article 246-3 of the Customs Act

- 5 If the importer is a tax delinquent who is to be sanctioned for arrears of taxes by the Head of the customs office according to Article 30-2 of the National Tax Collection Act

- 6 If the importer has been accused of or is being investigated for violating tariff-related laws

- 7 If the quality of items etc. is falsely labeled or mislabeled according to Article 230-2 of the Customs Act

- 8 If it takes a prolonged time to prepare the requirement for declaration acceptance according to the other customs clearance review.

After the declaration is accepted, the importer is required to make tax payments, including customs duties.

In principle, businesses with a high rate of law-compliance may receive benefits such as Post-clearance Tax payment

After the acceptance of the import declaration, a certificate of import declaration is issued.

The certificate of import declaration is protected by various measures to prevent it from being counterfeited or falsified: the special customs seal, a watermark (Korea Customs Service Emblem), serial numbers, a 2-D bar code, and a "copy" mark.

Release of the Goods

- After the import declaration acceptance is confirmed, the goods are released from the bonded warehouse/area.

Provided, goods urgently required, such as raw materials for production, may be released before accepting the import declaration.

Goods Subject to Customs Verification of Clearance Requirements

- The Head of the customs office checks whether they meet approval requirements and other conditions for imports under the relevant laws

specified in the directive on the designation of goods subject to customs verification of clearance requirements and confirmation method guidelines by Article 226 of the Customs Act.

Please note the types of tariff rates and priority.

Listed below are the types of current tariff rates.

| Type | Details and Legal Grounds | |

|---|---|---|

| National tariff rate | Basic tariff rate | The basic tariff rate stated in the Tariff Rate Table attached to the Customs Act |

| Provisional tariff rate | Provisionally applied tariff rate different from the basic tariff rate | |

| Flexible tariff rate | Anti-dumping duty, Countervailing duty, Seasonal duty, Adjustment duty, etc. Based on Articles 51 through 75 of the Customs Act (excluding Article 73) | |

| Conventional tariff rate | Tariff rate decided by a treaty or an administrative agreement with a foreign country | |

Note the priority of the application of tariff rates.

| Priority | Applicable tariff rate | Remarks |

|---|---|---|

| 1 | Anti-dumping duty (Article 51), Countervailing duty (Article 57), Retaliatory duty (Article 63), Emergency duty (Article 65), Emergency duty on the goods of specific countries (Article 67-2), Special emergency duty on agricultural and livestock products (Article 68), Adjustment duty (Article 69-2) | To be applied with priority regardless of the levels of tariff rate |

| 2 | International cooperation duty (Article 73), Beneficial duty (Article 74) | To be applied with priority only if it is lower than the tariff rate of 3, 4, 5, and 6 |

| 3 | Adjustment duty (Paragraphs 1, 3, and 4 of Article 69), Quota duty and Seasonal duty (Articles 71 and 72) | Note, however, that the Quota duty is to be applied with priority only if it is lower than the tariff rate of 4. |

| 4 | General preferential duty (Article 76) | |

| 5 | Provisional duty (Article 50) | |

| 6 | Basic duty (Article 50) |

Special tariff rates are applied to certain items

Simplified tariff rate

Applying a unified tax rate combining customs duty and internal(domestic) taxes

- 1 Goods subject to the simplified tariff rate

- ① Belongings of travelers or crew members

- ② Postal items (excluding objects of import declaration)

- ③ Consignment or separate shipment

- 2 Goods excluded from the application of simplified tariff rate

Goods specified in Subparagraphs 1 to 4, and 6 of Article 96-2 of the Enforcement Decree of the Customs Act

- (1). Goods with no tariff and with tax exemption

- (2). Raw materials for export

- (3). Goods related to the act of violating the regulations in Chapter 11 of the Customs Act

- (4). Goods subject to specific duties

- (5). Goods designated by the Commissioner of the Korea Customs Service among the items below

- A. Goods recognized as commercial volume

- B. High value goods

- C. Importation of the goods may damage the domestic industry

- D. Application of the simplified tariff rate according to Article 81-4 of the Customs Act may damage taxation equity

- (6). Goods to which the non-application of the simplified tariff rate for the total quantity of dutiable goods was requested by the cargo owner when the import declaration was made

- ② Goods their dutiable value exceeds 5 million won per unit or per set

- ③ Goods recognized as commercial volume

- ④ Goods to which a tariff rate higher than the basic tariff rate is applied among the goods to which tariff is applied according to Subparagraph of Article 49 of the Customs Act

Tariff rates under an agreement

Upon the prior agreement, the highest tax rate among the reported goods, at the request of the declarant, shall be applied to the goods with different tax rates.

Tariff for Specific use

Upon the approval of the Head of a customs office, a lower tariff rate may be applied when goods with different tax rates (basic, provisional, tariff rate under an agreement, flexible, etc.) when the goods are to be used for the purpose of the lower tax rate

Import Clearance Process Flowchart