Customs duty exemption and ex post facto management of exempted articles

Customs duty exemption and ex post facto management of exempted goods.

Customs Duty Exemption is Designed to Support the Government Policy Goals.

In principle, customs duties are imposed on import goods. However, in some cases, import goods are partially or fully exempted from customs duties unconditionally or under certain conditions. When the importer or the import goods meet specific requirements, to help achieve particular policy goals.

Customs Duty Exemption may be Applied for Differently Depending on the Uses and Condition of the Import Goods, Applicable Laws, etc.

Even for identical import goods, some may be exempted from duties while others may not depending on their uses and condition, the date of the import declaration, and applicable laws. Thus, the importer should make an accurate import declaration for the goods concerned and apply for duty exemption before accepting the declaration.

Customs Duty Exemption Application is Applied for before the Import Declaration is Accepted.

- To get customs duty exemption, the importer must apply for duty exemption to the head of a customs before the customs accept the import declaration for the goods concerned.

- The deadlines for the following exceptional cases are as follows:

Deadlines for Applying for Customs Duty Exemption(Article 112-2 of the Decree of the Customs Act)

- Where duties are collected pursuant to Article 39-2 (Notice of Duty Imposition by the Customs) of the Customs Act

- Within 5 days from the date on which the payment bill is received

- Where an application for duty exemption has not been submitted before the acceptance of the import declaration

- Within 15 days from the date on which the import declaration is accepted (limited to cases where the goods concerned have not been released from the bonded area))

Goods Exempted From Duties are Subject to Customs Surveillance for a Fixed Period of Time.

Where specific tariffs for a particular use, duty exemption, or installment payment of customs duties are applied, the goods shall be subject to follow-up surveillance for a certain period of time to ensure policy effectiveness and secure customs receivables.

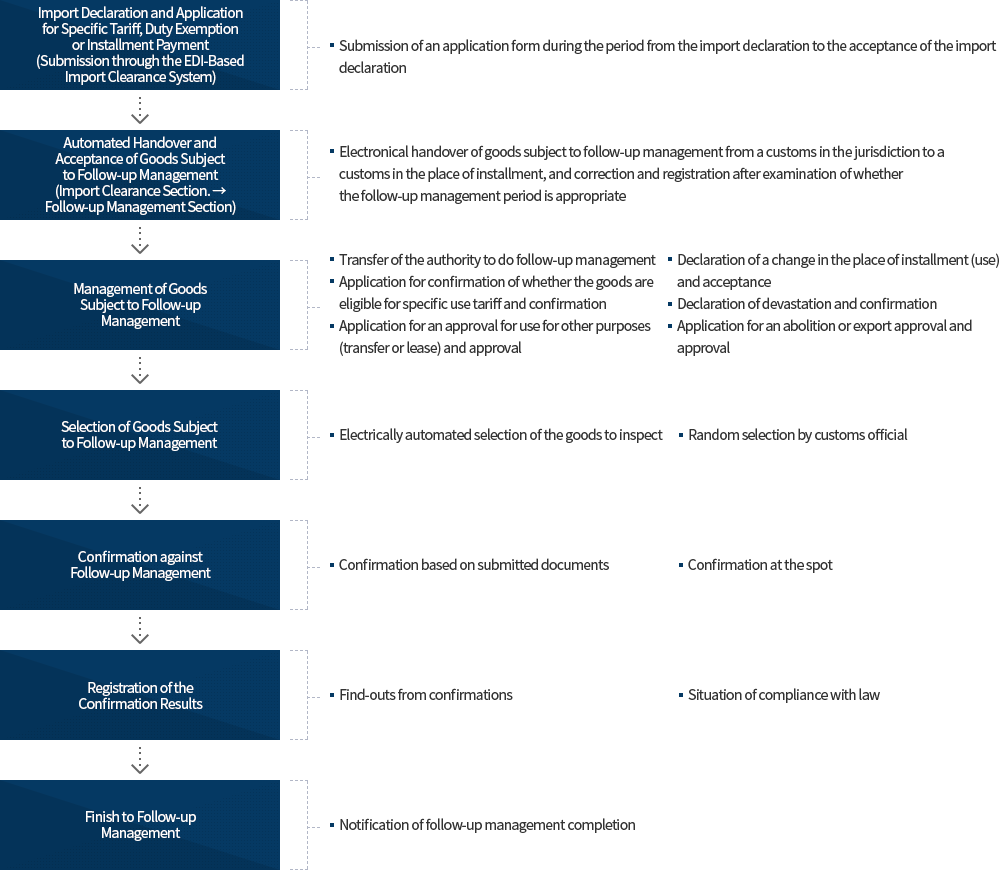

The flow of Post-Clearance Management