Duty drawback

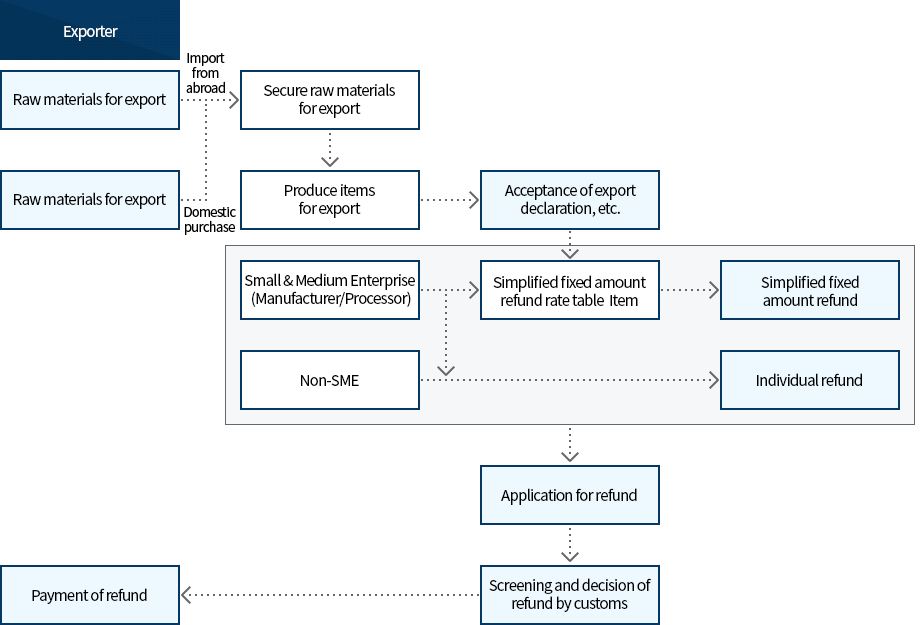

Overview of duty drawback

Duty Drawback Refers to Return of Customs Duties paid for Importation if Requirements under the Act on Special Cases Concerning the Drawback of Customs Duties, etc. Levied on Raw Materials for Export are Satisfied.

- Where imported raw materials are used for export, the exporter or producer may apply for a drawback and get a refund for the duties paid for the importation

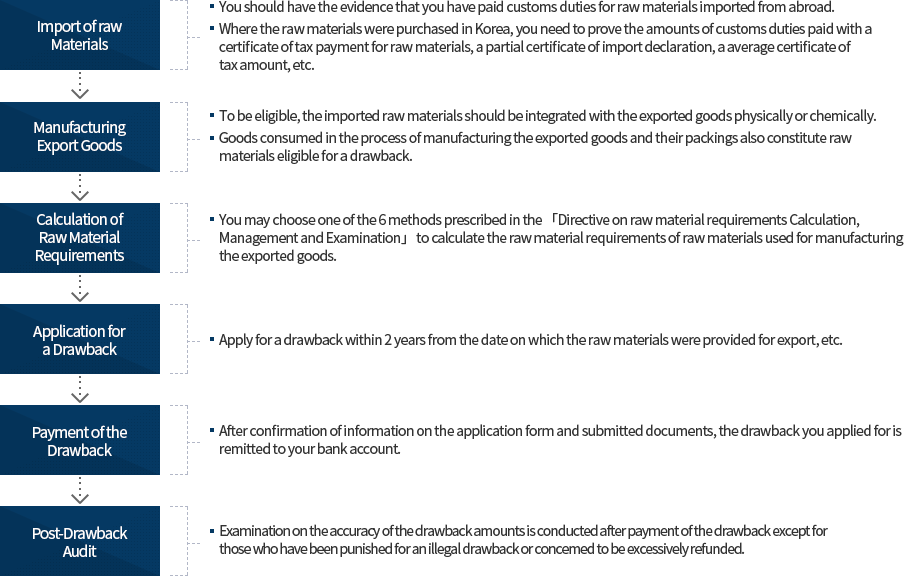

- An application for the refund of customs duty is to be made within 2 years of the date goods are used for export, etc. Customs duty, etc. for the imported raw materials used for the export of the product concerned can be refunded retroactively within 2 years of the date they are used for export, etc. (export implementation period).

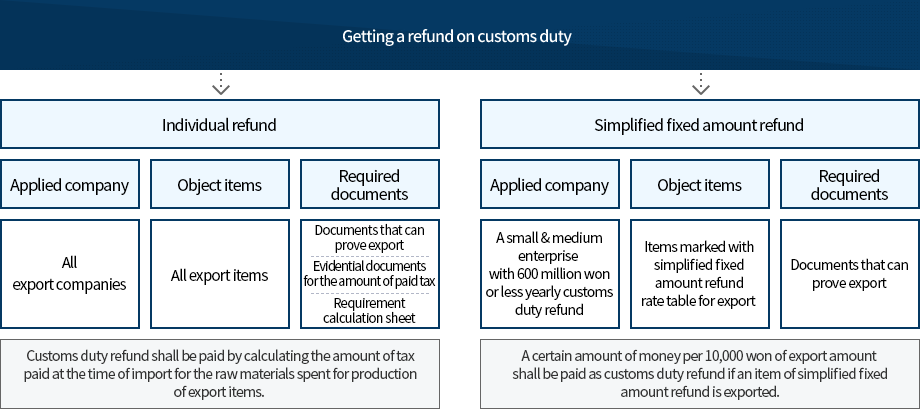

There are Two Types of Drawbacks: Individual Drawbacks which Require the proof of Tax paid and Simplified Fixed Drawbacks which do not so.

| Individual Drawback | Simplified Fixed Drawback |

|---|---|

|

|

- Simplified Fixed Drawbacks may be given to a small & medium enterprise that fulfills all of the following necessary conditions according to the regulation in Article 2 of the Framework Act on Small and Medium Enterprises:

- Manufacturers that received no more than KRW 600 million in annual drawbacks (including the drawbacks received by submitting a certificate of tax payment for raw materials) during the year in which an application for drawback is made and the two years just before the year and,

- Businesses that received no more than KRW 600 million in the drawback of the year in which an application for a drawback (including the drawback received by submitting a certificate of tax payment for raw materials) is made.

- An individual drawback refers to a refund made based on the amounts of customs duties paid for importing raw materials used for manufacturing exported goods.

- To get an individual drawback, you need to calculate the amounts of every type of raw materials used for manufacturing exported goods ("raw material requirements") to calculate the payments of customs duties paid for each of the raw materials. As a result, individual drawbacks are more accurate in the amounts of drawbacks but more complex in calculating the raw material requirement than simplified fixed drawbacks

Individual Drawback Process flow:

For More Information

Korea Customs Service Duty Resources Management Division 042-481-7873